How Many Credit Cards Should I Have?

Summary:

- Typically, it’s good to maintain 2-3 good credit cards (revolving).

- Utilization which is your balances vs. total available credit can impact your score.

- Several credit cards don’t directly impact your score, but can be harder to maintain.

- Having a good mix of credit is important.

So, how many credit cards should you have?

There is no set-in-stone rule how many credit cards a person should have. But from our experience 2-3 credit cards in good standing with low balances seems to be the sweet spot. This is in addition to other types of credit, like mortgages, installment accounts etc.

The amount of credit cards is less important than how you manage them.

- Obviously, always pay your bills on time.

- Always try and keep your balances below 30%

- Try and maintain a good mix of credit.

How having several credit cards affect your credit score

Having several cards can potentially affect your credit score in a couple ways.

When you have multiple cards you can lower your utilization rate which is your total available credit vs. your balances. Let me give you an example. Let’s say you have 2 credit cards, each with $1,000 limits, and you have a balance of $500.00 on each.

Total Available Credit = $2,000

Current Balance = $1,000

Utilization = 50%

50% Utilization is a bit high and could be negatively impacting your credit score. Now, let’s say you decide to open a third card and it too has a $1,000 limit.

Total Available Credit = $3,000

Current Balance = $1,000

Utilization = 33%

You just lowered your utilization from 50% to 33% which is much better. If you don’t feel like opening a new card, and you’re in good standing with your current credit card companies, you can ask them for a credit line increase which if approved, will have the same impact.

That is probably the fastest way to increase your credit score. It’s something we do with our clients who are trying to raise their score for a mortgage loan quickly

Now, the downside to opening a new card.

The more cards you have open, the harder it becomes to manage your payments. Having too many cards with different payment dates, dollar amounts and interest rates can become overwhelming. Not to mention the temptation to spend more which we’ve seen far too many times.

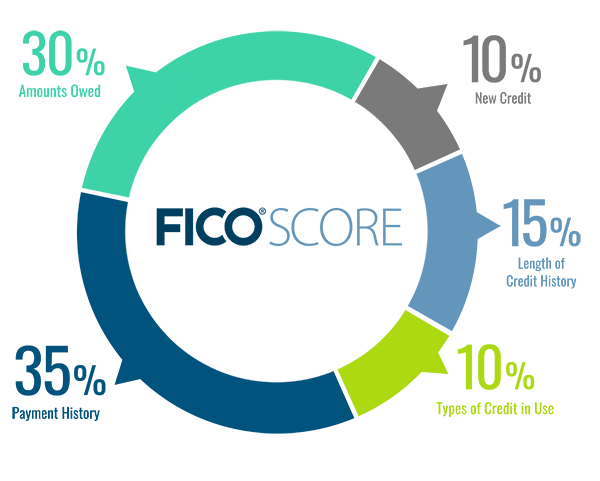

The second potential downside is your length of credit history. 15% of your credit score is the age of your accounts. The older the better. A brand new card is going to drop your average age of account. See graphic below of the FICO® score model

Should I close credit cards I dont use?

Generally, it’s best to keep cards open, for a couple reasons:

1. It’s going to impact your utilization.

2. You could decrease your average age of account

There are a couple things you need to be aware of if you have a card you don’t use and decide to keep it open. Some cards have a monthly fee. We’ve seen far too many people miss the monthly fee because they don’t use the card, forget about the monthly fee and end up with a late pay because of a simple oversight.

Some lenders will close your credit cards after extended periods of time due to inactivity. So, again… staying on top of your credit is key.

Times when its appropriate to close credit cards you don’t use.

If you are the type of person who just can’t control their spending, sometimes it might be best to close unused cards. There are a lot more people than you might think with this problem. We’ve seen people freeze their cards in a bowl of ice. Some people leave them in a sock drawer. We’ve seen people store them in a safe deposit box… spending is a big problem for some people. Do whatever works for you.

Another time where it may be appropriate is when the monthly fee is just so much (more common with bad credit, credit cards). If you think the fees are just too much to justify keeping the card, then maybe it is worth it.

What is a good mix of credit?

There are different types of credit.

Revolving lines of credit: Revolving debt is basically credit cards. You borrow a certain amount of money and pay it back via monthly payments, or one time lump sum payments. When you pay it back, you can re-use it if you like.

Mortgage loans: These are pretty similar to installment loans except that the interest can be fixed or variable.

Installment loans: An installment loan is a loan that’s paid back,with interest, via regular payments over a period of time, and the payment amount typically stays the same. When the loan is repaid, the account is closed. An auto loan is considered an installment loan.

A good mix of credit would be:

- 2-3 revolving (credit cards) all with balances below 30% of their limits.

- A mortgage

- An auto loan