What is a good credit score for a mortgage?

Learn what type of credit scores mortgage lenders are looking for, and what you can do to make sure your credit is loan ready.

What’s considered a good credit score by mortgage companies?

As you get near that time in your life when you are ready to take a big step and purchase a new home. You start searching for a home, you find the one you like only to be told you do not qualify! Most people just dive right in without thinking about how their credit or finances will impact them when they are ready to pull the trigger. Let us drill down the steps you should take before applying.

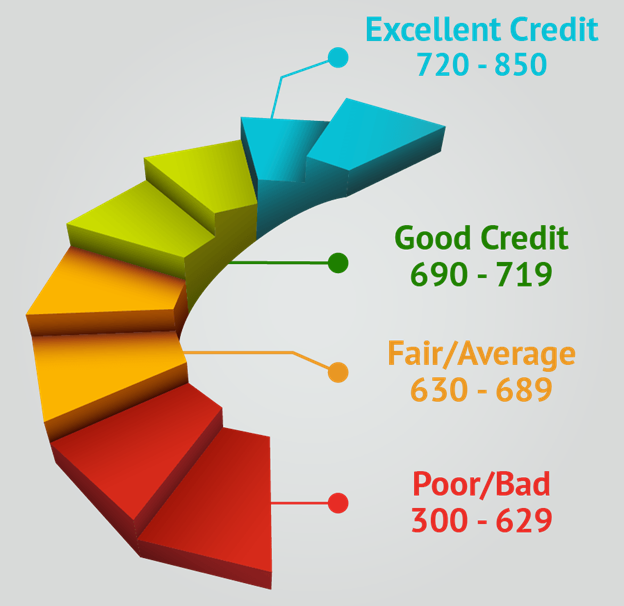

Minimum credit score to buy a house

Your Mortgage Lender will consider the credit score needed, the loan type, down payment amounts, and debt to income ratio.

FHA Loan Requirements

• FHA Loan is Insured by the Federal Housing administration. Keep in mind that you will pay MIP on top of regular mortgage insurance.

• FICO® minimum score requires a 3.5% down payment.

• FICO® credit score between 500-579 requires a 10% down payment

• Debt to income ratio is <43%

• Must be a primary residence

• Must have steady income and proof of employment

Conventional Loan Requirements

• Most conventional loans are “conforming loans,” which “conform” to a set of standards set by Fannie Mae and Freddie Mac. NO PMI with a down payment of 20%

• FICO® credit score at Minimum 620 for Fixed and 640 for adjustable

• Down payments can be 3% for first-time home buyers. Normally 5% with PMI and 20% for no PMI.

• Debt to income ratio is 45-50%

• Can be used for primary, second home, and investment property

• Must have steady income and proof of employment

Department of Veterans Affairs

• The VA does not set credit score requirements, but the lenders will.

• FICO® credit score at Minimum 580 – 620

• No down payment

• Click here to view the VA Pamphlet

U.S. Department of Agriculture

• U.S. Department of Agriculture (USDA): USDA loans are mortgage back by the U.S. Department of Agriculture. Mainly available to low- and average-income families.

• FICO® credit score at Minimum 640

• They offer no down payment and reduced mortgage insurance

• Must have steady income and proof of employment

*All lenders have specific requirements for the loans they offer. Be sure to have everything needed that they request. Common items will include, w2, recent paystubs, tax returns, proof of employment, etc.

How to check your FICO® Credit Score

Checking your FICO® Credit Score is the first step. You can check it at www.myfico.com. Most lenders use the Mortgage FICO® not to be confused with general credit scores that you will usually see with Credit Karma or other credit monitoring sites you may be using. The mortgage industry uses the following versions:Equifax: FICO® 5 occasionally referred to as Beacon 5.0

Experian: FICO® 2 occasionally referred to as FICO® V2 or FICO II

Transunion: FICO® 4 occasionally referred to as FICO® Classic 04

How to raise my score for a mortgage loan

There are many ways to try to obtain a home loan with less than stellar credit; however, you may end up paying more in interest or worse yet, get declined for the home of your dreams. Be patient and get your report as good as possible prior to obtaining that approval. Below are a few suggestions on how to raise your credit score.

1. Reduce your credit card balances: As a rule, you want to keep your credit card balance at 30-35% of the credit limit. If any of your balances are above that, get them paid down prior to applying for the home loan.

2. Avoid applying for new credit: Unless you have a thin file and need to establish credit, avoid opening revolving credit and installment accounts. Opening new accounts prior to getting a home loan decreases the score initially and brings down the average age of credit accounts. You also do not need the extra inquiry.

3. Experian Boost™. Experian can assist in raising the FICO® Score by using Experian boost, you can add unconventional items to your credit report, Utilities, cell phone bill, and other qualifying items. Be sure to check it out. Equifax and Transunion have not followed suit yet.

4. Get added as an Authorized user: If you have a family member with a good credit card and good payment history, see if they will add you as an authorized user

How to get a mortgage with a bad credit score?

We all want a perfect situation but sometimes life does not quite deliver in a timely manner, but that does not mean you cannot purchase a home with a bad credit score. If you want to give yourself a better chance at qualifying, below are a few suggestions

1. Make on-time payments: Stay current with your current obligations. Make your payments on time.

2. Have a bigger down payment: Save as much cash as you can for a down payment. The more you can put down, the better the lender will feel.

3. Limit Inquiries: Avoid applying for any new credit, doing so will affect the credit score initially.

4. Work on your debt-to-income: Your Debt to income relates to how much debt you owe versus how much money you make. The higher the debt to income the less chance you have of getting approved.

5. Be realistic: Yes, you can buy the home, but will it be the home of your dreams or will you have to settle? You will most likely have to settle. With a poor credit score, the home you had in mind may not be the home you qualify for, but it’s not the end of the world, right? So, either wait or buy that starter home, work on your credit, get into a better situation and when the time is right, sell your home and get into the home of your dreams!

How to Repair your credit for a mortgage

When you are ready to make that leap and purchase a home, give yourself some time to Repair your credit prior to applying. Try not to settle for just the minimum credit score to buy a house Below are some steps you should take.

1. Get your credit report: Obtain your credit report from www.annualcreditreport.com, they are very detailed and are considered a soft pull.

2. Review your Credit Report: Once you have the credit reports, go over everything with a fine-tooth comb. Look for errors in balances, date opened, unfamiliar inquiries, collection accounts you do not recognize, and credit accounts you may not recognize. You can reach out to the credit bureaus regarding these items. This process can be tedious and frustrating. You can always call a credit repair company to assist you in the process.

3. Reduce Balances: Pay down any Credit Cards that are above 30% usage.

4. Avoid New Credit: Unless you need to build your credit, avoid opening new credit accounts. The less debt you have the better.

5. Public Records: Check your public records for any outstanding judgments or tax liens. These two items do not report on personal credit reports anymore.

Additional Factors that can affect a mortgage approval

Most consumers focus on the credit score as being the main factor for approval, it is not. Below are other situations you will run into aside from your credit score:

• Income: How much you earn is a major factor. Lenders want to make sure you can afford to make payments on time every month.

• Job history: Most lenders want to see that you have a stable job. Try to maintain a solid 2-year work history. If you do change jobs, try to keep it in the same industry.

• Down payment: The higher your down payment, the less you need to borrow from the lender, which is an added plus.

• DTI: The higher the DTI, the less chance you have in procuring a loan. It is important to demonstrate to a potential lender that you can take on the home loan without issues.

• Cost of home: This goes without saying. If the cost of your home is too high, the less likely the lender will approve especially if you fail the DTI category.

• Derogatory marks on your credit: As with anything you try doing today, derogatory marks on the credit report can put some lenders off. It is wise to repair your credit prior to applying for a home loan.

If you don’t feel like repairing your own credit and think you might need to hire a credit repair company, here are some resources:

Credit Repair process

How to avoid credit repair scams

What are no down payment loans?

There are 2 types of loans that offer no down payment and those are VA and USDA. There are 1st time home buyer programs that will help cover the cost of the down payment and there are some private lenders that will offer low to no down payment loans, but it is lender specific so do your homework.With a higher down payment, you are more likely to enjoy a better interest rate and if you are lucky and are able to fork up a 20% down payment you can avoid PMI. Who does not like to save money?

With a no-money-down loan, you will most likely not enjoy those perks and will have to pay that PMI, but don’t let that credit journey end, keep working on your credit because in 6 months or however long it takes to get your credit in better standing you can refinance out of your current loan and into a better-structured loan without the PMI. Market conditions of course will need to be considered.

Need a little help getting your credit report home loan ready?

Feel free to schedule a free consultation. My Credit Group specializes in helping consumers get their credit score home loan ready. Schedule a FREE credit repair consultation. We’ll go over every detail of your credit report and let you know what steps you can take to make sure you’re ready.