How to Remove your name from Joint Account

Having a joint credit card can be very helpful in certain situations for you and your spouse. A joint credit card helps both credit reports and makes it easier to pay and track your bills. Or maybe you have a teen child that is not yet ready to control a credit card on their own, but you want to them start building their credit and learn about financial responsibility, what happens If things did not work out and it is time to end that joint relationship?

Do you just call up the creditor just ask them to remove your name from the joint credit card, sounds reasonable, right? Not so fast.

Accounts that are held jointly do not have the same ease of removal as authorized-user credit cards, you will need to pay off and close a joint credit card account in order to be free of the user you no longer wish to share a credit card with and both cardholders will need to agree to close it.

How to Close a joint credit card

It is not hard to close a joint credit card as long as both parties are in agreement to terminate the account in question. Of course, like with most things that are held jointly, there are steps to be taken that you can follow on how to close a joint credit card.

-

-

- If you have the means to pay off the balance. That is the ideal scenario as the creditor that issued the card will most likely want it paid off before the close the account. If you are lucky and the creditor does not require it to be paid off once you request it to be closed, be sure to continue to make the on-time minimum payment or more until the account is completely paid off. In situations where you and the other party are in not so good terms, it might be wise for both of you to come to an agreement and accelerate paying off the credit card before the situation has a chance to get worse. Be mindful, not paying on the credit card will affect both your credit reports and scores.

-

- Redeem rewards. Most credit cards have rewards. If the joint credit card has rewards, obviously redeem them and split them in half with the other party prior to closing out the account.

-

- Once the credit card is paid off and all rewards have been redeemed, go ahead and call the creditor and close the account. Make sure nothing else is owed and you have met all their terms.

-

- Once the account is closed continue to monitor the request. You can ask them to send you an email or letter of confirmation once the account has been officially closed. If you do not get that email or letter in a timely manner, be sure to follow up with the credit card issuer and monitor the credit reports to make sure the account updates as closed

.

- Once the account is closed continue to monitor the request. You can ask them to send you an email or letter of confirmation once the account has been officially closed. If you do not get that email or letter in a timely manner, be sure to follow up with the credit card issuer and monitor the credit reports to make sure the account updates as closed

- If you cannot come to an agreement prior to any late payments occurring you may want to consider a balance transfer card. There are several options out there and this step alone will not only save your credit but can reduce the monthly payments at a 0% interest rate. These cards will offer this promotion for a set period of time. During this time, you will be responsible for paying off the balance you transferred before the promotion expires. Hopefully, by then you could work out our differences, and the other party covers their half of the bill at some point. Fingers crossed.

-

Does Closing a Credit Card Hurt Credit Score?

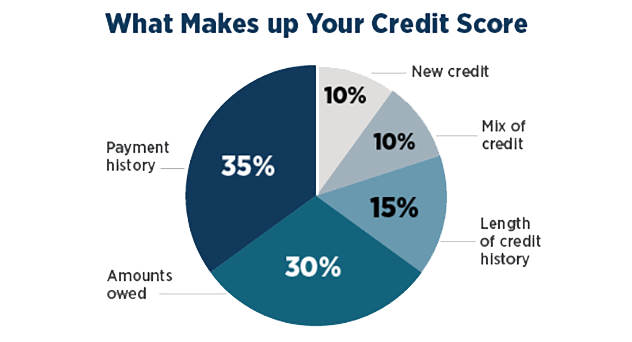

The question has to be asked, does closing a credit card hurt your credit score? Yes, if the credit card account you are closing has been established and is in good standing. Closing it will have an impact on the credit score, the same goes for joint credit cards. Credit to debt ratio is very important to credit scoring algorithms.

When you close an account, you also lose that available credit which in turn raises your debt-to-credit ratio. The lower the ratio the better for your credit health and score. Credit utilization is one of the most important factors in your FICO® Score® history.

Another issue with the closure of a joint credit card, or any credit card for that matter, is age. If the account has been open for several years it has a direct impact on the bettering of your credit score. The longer your credit history, the better you look. I guess it’s true, you get better with age 😉

When you do close a joint credit card account and it was in good standing, it will remain on the report for 10 years.

The most important thing to remember, closing the account will hurt for a tiny bit, your score will be on the mend as long as you have active credit and you are in good standing, the good thing is now you do not have to worry about that joint account anymore which could have caused far more damage than paying and closing it.

In Closing

We all wish things could be easier in life, but that is not how the credit world works. Hopefully, you and the other party can work out an agreement without any issues and life can go on. We will all run into some stumbling blocks, but as long as you are prepared and you take the proper cool-headed action, you will come out unscathed. And maybe the next time you think about being a joint credit card holder, you will not be so quick to sign on the dotted line.