How inquiries affect your credit

For the last 19 years of being in the credit repair business, a day hasn’t gone by where we have received at least one call where the potential client says something like ” I have a collection, a late payment, and I think a repossession. But I’ve really got to get these 5 inquiries off my credit”

So, I figure it’s long overdue that we explain what inquiries are, and how inquiries affect your Fico score.

An inquiry is when someone pulls your credit, and it generally falls into one of two categories.

-

-

- Hard Inquiry

- Soft Inquiry

-

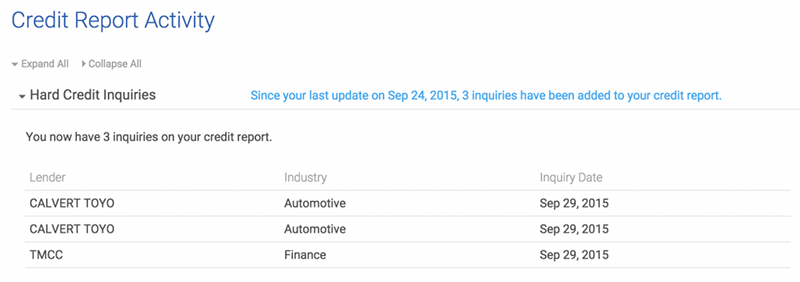

What Is a Hard Inquiry?

When a lender or company requests your credit report as part of the loan application that you filled out, whether it be a home loan, auto, or credit card, that is considered a hard inquiry, and in most cases will have a small impact on your good credit score.

Hard inquiries stay on your credit report for 2 years, but the negative impact on your credit score is typically only 1 year. Those timelines will vary slightly depending on your unique credit profile which I’ll explain in a minute.

The reason for the timelines is to give potential lenders some insight into your current situation. For example, if you apply for a loan of some sort, and the lender sees you’re currently applying all over town, that may be a factor in his risk assessment of you.

Are you going on a giant shopping spree? Are you getting denied everywhere else? So, you don’t want too many recent inquiries on your report.

Type of Inquiry? Hard.

Negative impact? Yes.

How long they stay on your credit: 2 years.

Amount of time they have a negative impact? 1 year.

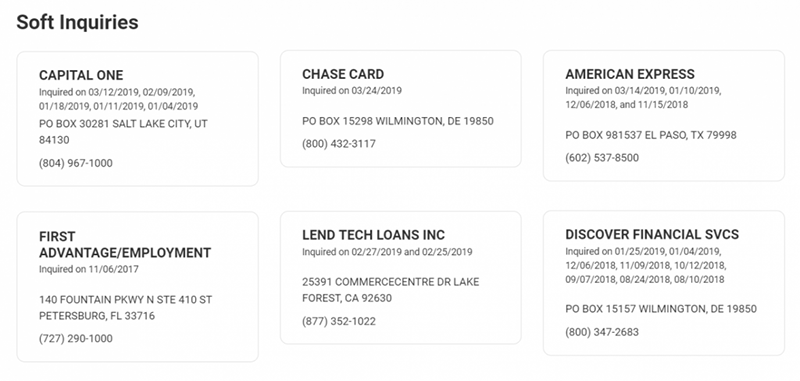

What Is a Soft Inquiry?

A soft inquiry is when you pull your own credit report from a monitoring site like MyFICO, annualcreditreport, or even directly from the credit reporting agency.

Other types of soft inquiries are employers, or sometimes a company you already have credit with will pull your report to perhaps to see if they want to offer you more credit, etc. These are all soft inquiries and do not hurt your credit score.

Type of inquiry: Soft.

Negative Impact: No.

How long they stay on your credit: 2 years.

How many hard inquiries are too many?

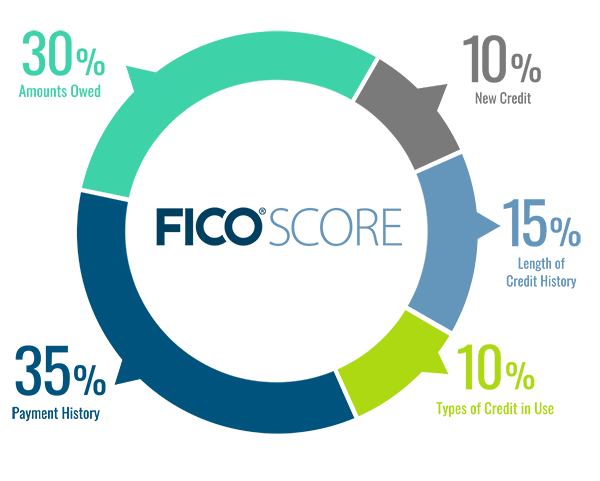

There are several factors that go into your credit score and hard inquiries are actually a pretty small part of the equation. Not only that but how inquiries affect your credit score varies from person to person

Let me explain…

Let’s say Sally hasn’t had any hard pulls on her credit in the last 3 years and her credit is in pretty good shape. Sally can easily afford to get a couple of hard pulls over the next couple of weeks, and the negative impact would be pretty minimal. Maybe 6-7 points and it the negative impact would diminish pretty quickly.

Johnny on the other hand has been applying for credit all over town lately and his credit is only fair. In this case, it’s possible each one of Johnny’s is worth 5 points by our estimation.

Personally, I recommend our clients stay below 5 inquiries over a 2-year period if possible.

Ways to manage the impact of hard inquiries

A little homework and preparation can go a long way when it comes to minimizing the damage that hard inquiries can do. Check with your bank to see if you’re pre-approved.

Places like creditcards.com and capital one have all kinds of tools to see which cards you’d likely be approved for before pulling an actual report.

Apply for only the credit you need. Credit is one of those necessary evils. It’s pretty difficult to do anything without a good credit score. But apply for only what you need, and make sure you have a good credit mix.

Monitor your credit. Knowing exactly what’s on it at all times will help you decide whether or not it’s a good time to be applying for new credit.

Multiple Inquiries When Shopping for a Car Loan

When you’re shopping for a new car, it’s very common for auto dealerships to send your credit reports to multiple banks. This is called rate shopping, and it’s pretty much just as it sounds. The dealership is shopping your application around looking for the best rates.

We’ve seen people get shopped at 15-25 banks in a single day. But, here’s the good news. The credit bureaus know this is typical, and if the auto pulls are all within a short period of time ( I think it’s 45 days for FICO® and 14 for VANTAGE) they are counted as one hard inquiry.

The same goes for mortgage loans. Brokers will shop your application around to several banks trying to find you the best home loan and they are counted as one just like auto loans.

Important to note: All of the inquiries will show on your report and it looks sloppy, but they are counted as one.

How to Remove Hard Inquiries

If you check your credit report and see that there are hard inquiries, you’ve got a couple of options.

-

-

- We have a guide on credit dispute letters

-

- You can hire a professional credit repair company like My Credit Group

- You can follow the steps below.

-

If you go through step one and dispute the inquiry and discover that it’s a form of fraud or identity theft, report the identity theft to the FTC. Then, send a letter to each credit reporting agency requesting the removal of the fraudulent inquiry. Be sure to include a copy of your FTC Identity Theft Report with your letter.

You can send your letters to the addresses below:

Experian. Dispute Department.

PO Box 4500. Allen, TX 75013.

Equifax.

PO Box 740256. Atlanta, GA 30374-0256.

TransUnion Consumer Solutions.

PO Box 2000. Chester, PA 19016-2000.

and you may want to add a fraud alert and credit freeze on your credit.A fraud alert will not prevent you from applying for new credit. A fraud alert will alert creditors accessing your report to take extra steps to verify your identity. They are free and do not impact your good credit score

You may also want to consider placing a credit freeze on your credit reports A credit freeze will help prevent new accounts from being opened in your name. This too is free and does not affect your good credit score.

Conclusion

Hard inquiries can temporarily impact your credit, but if your credit is in good shape, the damage is going to be very minimal and temporary.

If you have questions or would like a free credit repair consultation, feel free to sign up below. We’d be more than happy to look at your credit report and let you know what you can do to ensure it’s in the best shape possible.