What is a good credit score?

Credit scores are one of the most defining factors lenders take into consideration to determine whether to give you a loan. Be it a home, auto, credit card, or even renting an apartment.

Your credit score dictates what your interest will be, or even if you get approved. If you have good credit, you’re going to pay a lot less for life’s little luxuries. If you have bad credit, you’re going to pay a lot more.

So, it’s in your best interest to understand exactly how to manage your credit scores.

Basically, a credit score is a mathematical prediction of how likely you are to be able to pay back a debt.

Who are the 3 main credit bureaus?

Experian, Transunion, and Equifax

Credit bureaus (also known as credit reporting agencies) are private companies that collect data reported to them by creditors. They use that data to calculate your credit score.

A common misconception about credit bureaus is that they make lending decisions. They do not. Credit bureaus provide some of the information creditors and lenders use to help them make lending decisions.

What is the credit score range?

FICO® Range: 300-850

VantageScore 300-850

What is a good credit score – FICO®?

FICO® has different types of credit scores.

Base FICO®: This is designed to predict the likelihood of defaulting on things like a mortgage, credit card, student loan, etc.

Industry-specific FICO® It’s essentially the same as a base score but tweaked slightly to have a narrower focus than the base score. For example, an auto dealer may pull an “auto specific” score vs. just a base score.

It depends on the lender whether he wants to pull a base or industry-specific score.

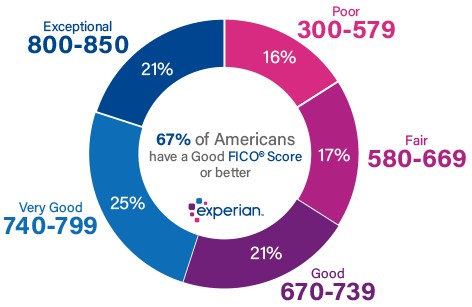

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range—250 to 900

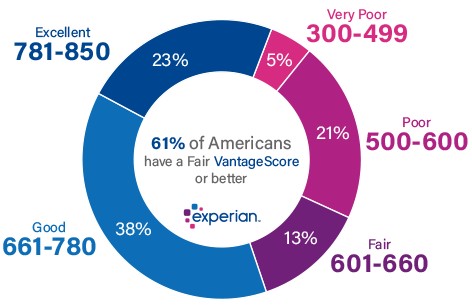

What is a good credit score for VantageScore?

The latest VantageScore credit scores (VantageScore 3.0 and 4.0) use a 300 to 850 range like the base FICO® Scores, VantageScore defines 661 to 780 as its good range.

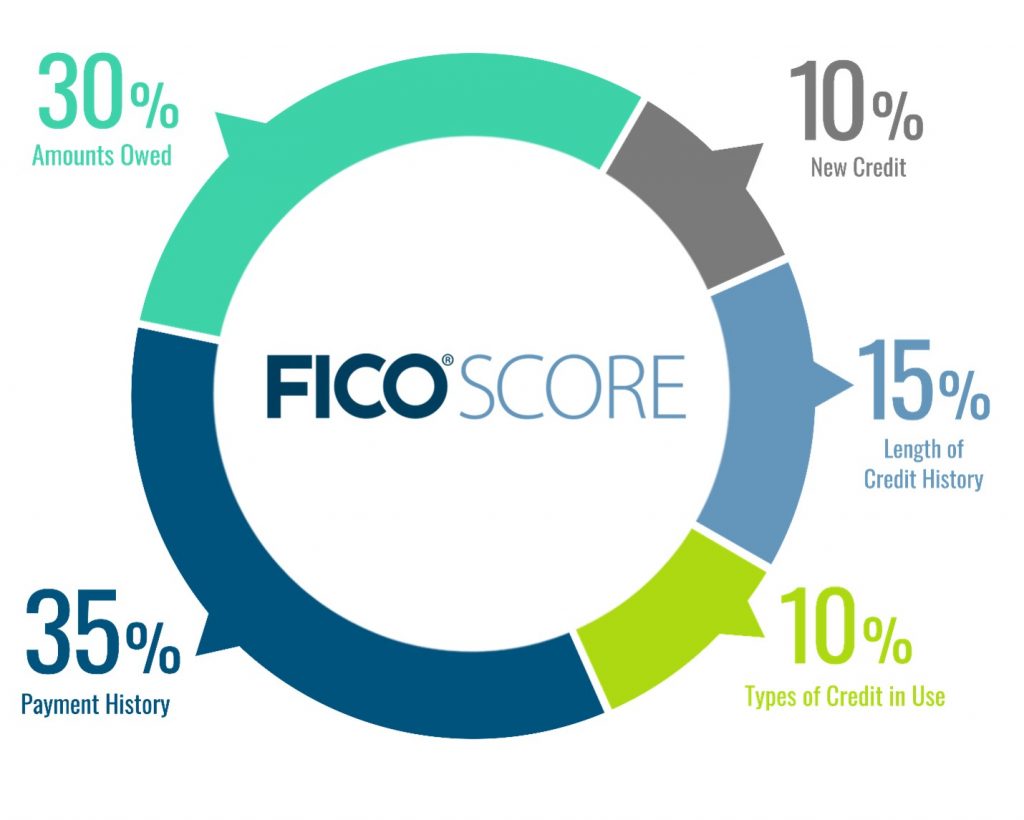

How are FICO® scores calculated?

FICO® breaks your credit score down into five categories to determine your credit score, but it can vary depending on your unique credit profile.

• Payment history: 35%

• Amounts owed: 30%

• Length of credit history: 15%

• Credit mix: 10%

• New credit: 10%

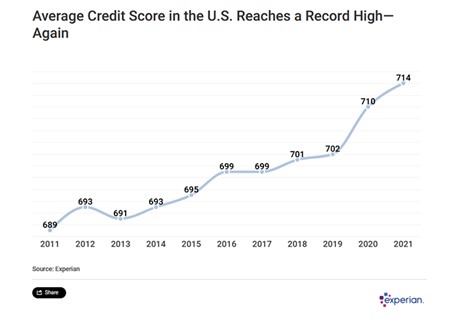

What is the average credit score?

According to Experian the average credit score has increased over time and hit an average of high of 714 in 2021

Things that are NOT factored in your credit.

• Your age

• Where you live

• Your race, color, religion, national origin, sex, or marital status

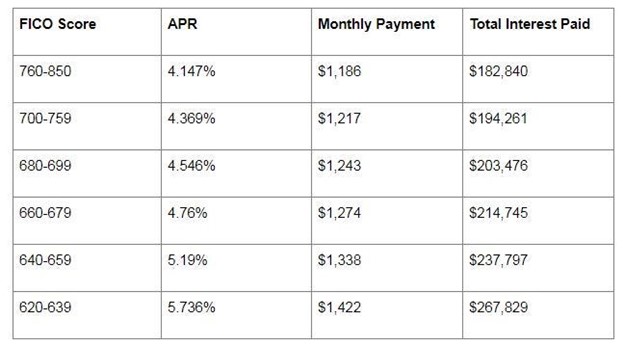

Bad Credit is expensive

According to Forbes, you can see the difference in a mortgage payment between a good credit score and an average credit score is $236.00 per month or $84,989 over the life of the loan.

Where to get your credit report free?

The Fair Credit Reporting Act (FCRA) gives you the right to obtain a free copy of your report, including when:

• A creditor declines your application due to the information in your credit report.

• You’re unemployed and looking for work.

• You’re receiving public assistance.

• You believe you’re a victim of fraud.

You can usually get it free at annualcreditreport.com You can also get them directly from the credit bureaus.

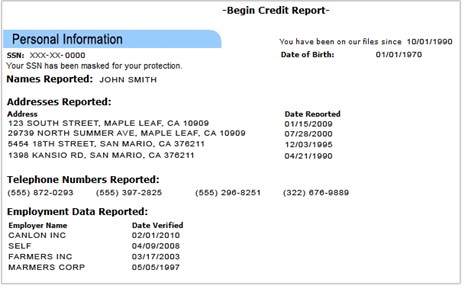

How do you read your credit report?

It is vital that you look over every detail of your credit report starting at the top which includes your personal information.

Information you’ll find here is your, former names, aliases, social security number, birth date, employers and contact information.

You want to make sure there are no misspellings (which is very common) no incorrect previous addresses, typos… anything.

Personally, I like to keep my credit report very clean. Anything I don’t recognize or think is inaccurate I dispute. That includes addresses, previous employers, etc.

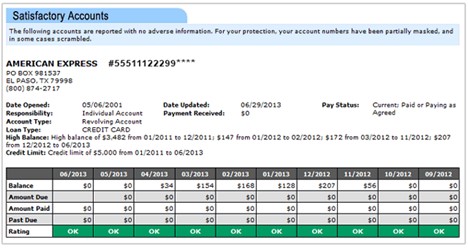

Credit accounts listed on your credit reports

Lenders or creditors report to the credit bureaus the accounts you have with them. They report the type of account (auto loan, credit card, etc.), the date you opened the account, your credit limits, balances, and payment history.

This information is the majority of what FICO uses to calculate your score. Obviously, it’s important to check your reports regularly to make sure everything is accurate.

What to look for

Essentially, you want to look at every detail. Not only can a single error on your credit report harm your credit score, but it may also get you denied from other types of loans.

Not only that, but spotting errors is also going to help repair your credit.

• Open and closed dates

• Balances and payment history

• Names of creditors

• Inquiries

• Public records

How to dispute errors on your credit report?

So, if you’ve gone over your credit report and noticed some things that either don’t sound right or you don’t recognize them, you need to dispute those items. They could be harming your credit and may be a sign of identity theft.

You’ve got a couple of options when it comes to disputing inaccurate or unverifiable information on your credit report.

Disputing with the credit bureaus

Equifax

Dispute Online:

Dispute by mail:

Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30348

Dispute by phone: (866) 349-5191

Experian

Online:

By mail:

Experian

P.O. Box 4500

Allen, TX 75013

By phone: (888) 397-3742

TransUnion

Online:

By mail: Download the dispute form

TransUnion LLC

Consumer Dispute Center

P.O. Box 2000

Chester, PA 19016

By phone: (800) 916-8800

What happens during the credit dispute process?

Per the Fair Credit Reporting Act (FCRA) the credit bureaus must investigate your dispute and forward all documents to the creditor who reported it to the bureaus unless they determine your claim is frivolous.

If the credit bureau decides that your dispute is frivolous, it can choose not to investigate the dispute so long as it sends you a notice within five days saying that it has made such a determination.

*Note: getting a “frivolous” response can be a big problem when hiring lazy credit repair companies who use automated dispute systems.

If the creditor fixes your information, it must notify all the credit bureaus so they can update their reports with the correct information. If this happens, depending on your personal credit profile, your score should increase.

If the creditor determines that the information is accurate and does not update or remove the information, you can request the credit reporting company to include a statement explaining the dispute in your credit file. This statement will be included in future reports and provided to whoever requests your credit report.

Is it worth hiring a credit repair company?

If you don’t feel like trying to fix your own credit score, there are professional credit repair companies that specialize in improving credit scores.

Now, there isn’t anything a credit repair company can do that you can’t do yourself; they don’t have any secrets or backdoor methods. They can, however, save you a lot of time and should know the system better than most consumers.

Something to be aware of:

Most credit repair companies are what we call “dispute mills”. Their automated software simply disputes everything negative on your credit report with a template dispute letter.

Personally, I think that type of service isn’t worth the paper the disputes are written on. Some credit repair companies are straight-up scams.

On the other hand, if I may drop a little shameless promotion. My Credit Group has been in the industry for 18 years and is utilized by hundreds of mortgage lenders to help their clients get approved for home loans.

You can see our credit repair process here

Conclusion:

When it comes to your finances, your credit score has to be priority #1. If you have a bad credit score, everything is going to cost you more. I hope this article helped in some way and if you need any help at all, please feel free to reach out to us.