Is paying someone to fix your credit worth it?

I recently read an article over at Experian, which you can read here, written by John Ulzheimer, on why you shouldn’t pay someone to fix your credit. If you need to know who John Ulzheimer is, he is an expert on credit and credit reporting with nearly 30 years of experience. You can visit his site here.

I had the pleasure of speaking with John a few times back in 2005(ish), and he knows what he’s talking about

So, where do I differ?

It’s not that I differ in opinion on those topics as much as I’d like to offer more to the conversation.

Indeed, disputing everything negative on your credit report is almost guaranteed to be a waste of time and money (in addition to being unethical, potentially even illegal).

But, in our 19 years of business, we have found that most consumers don’t know what constitutes inaccurate. Last payment dates, state and federal statutes come into play, as well as dollar amounts and several other factors.

But it’s not only that…

Knowing when you should settle a debt instead of disputing it, how much you should settle for, or even when to ignore a debt are also factors.

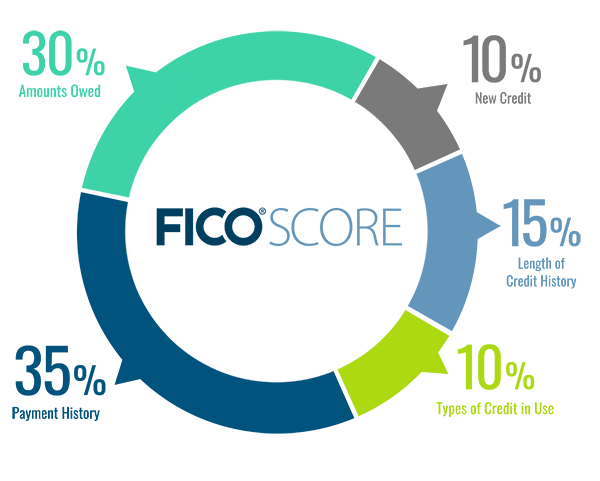

When you should apply for new credit and when you shouldn’t are also part of the credit equation. There is a lot that goes into building that “perfect credit mix”

Below is a graph of how your FICO® score is calculated.

“Fixing” credit is more about education than it is disputing.

Understanding how your credit score is calculated is vital to “fixing” or rebuilding a negative credit profile.

For example, we have found that most people don’t understand how much a high utilization rate can damage their credit score. They’ll come to us worried about the five inquiries they have; meanwhile, their utilization rate is in the high 80s.

In cases like this, it isn’t about “repairing” your credit as much as it is about understanding your credit and making some lifestyle adjustments.

Do dispute letters work?

Yes, dispute letters are sometimes part of the process, and yes, we’ve had hundreds of thousands, if not millions, of items removed from credit reports using dispute letters. But they’re deleted because something was inaccurate not because it’s a “secret weapon” that only credit repair companies know how to word correctly to get the best results.

During our consultations, if we know an item is accurate, we won’t even bother disputing it, and we’ll tell you that right up front.

We may offer alternatives like making payment arrangements, but we’re not going to waste your time with frivolous disputes which won’t help you.

So is it worth paying somebody to fix your credit worth it or not?

It can be, but unfortunately, in most cases, it’s not.

A negative credit profile can be fixed (I think a better phrase is rebuilt). However, it takes some time to educate yourself on how credit scores are calculated, it may take making payment arrangements with creditors, and yes, dispute letters may be involved.

So, if it’s worth it to you to pay for that education and some of the headaches of arguing with creditors, then I think education is well worth the money. We’ve have a list of the best credit repair companies here

If you think credit repair is about sending a bunch of dispute letters to capitalize on a legal loophole, save yourself the money.

The reason this industry is so frowned upon is not that it’s illegal; it’s because most credit repair companies promising to fix your credit are lazy and rely on disputing everything negative, which is almost certainly going to be a massive waste of money.

How much should you pay for credit repair?

If you’ve decided it might be worth your time and money to pay someone to fix your credit, the cheapest we’ve seen is 79.00 per month; some get up into the thousands., but most come in around 100-150 per month.

FYI MyCreditGroup fees are 89.00 per month. We include the education part we’ve been discussing. The disputes, if necessary, and debt settlement if it’s needed for that same price. Our services

Do I know what I’m talking about?

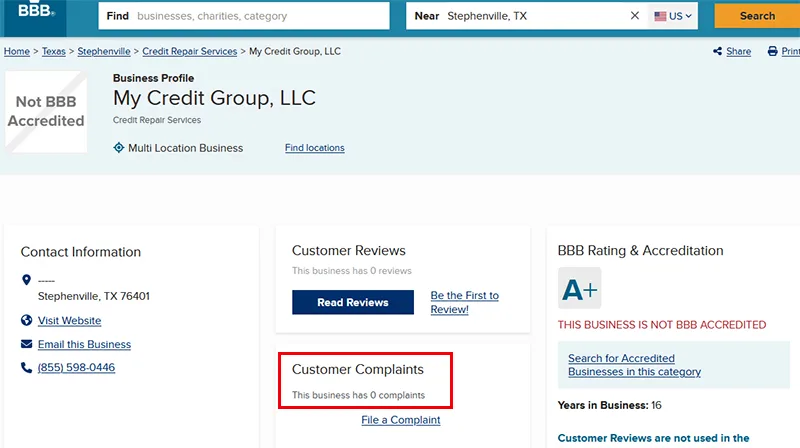

It’s a fair question. We’ve been in business for 19 years. (BBB says 16, but we switched from a corporation to an LLC and had to re-register) And we maintain an A+ rating with the BBB and have never had a single complaint.

I want to think that says something about our services, experience, and our honesty.

Can I repair my credit myself?

You can. You can get a free copy of your credit report from each of the three credit bureaus every 12 months at annualcreditreport.com.

If you see errors on your credit report, you can file a dispute online here

And do the same with Experian and Transunion.

You can also mail dispute letters to the three credit bureaus:

-

-

- Equifax. P.O. Box 740256. Atlanta, GA 30374-0256.

-

- Experian. Dispute Department. P.O. Box 9701. Allen, TX 75013.

- TransUnion. Consumer Solutions. P.O. Box 2000. Chester, PA 19022-2000.

-

Once you’ve removed any inaccurate information (if there is any), you need to educate yourself on what affects your credit score.

We have some resources here:

The fastest way to repair your credit

How to avoid credit repair scams

How inquiries affect your credit

Conclusion:

You can rebuild a bad credit profile. We’ve seen people go from the 400s to the 700s. But it’s about education, time, and responsibility. Yes, I firmly believe we can save you a lot of time and know the straightest path from point A to B, but we don’t have any magic bullets.

If you’re interested in chatting, we’d love to hear from you. Feel free to schedule a free consultation and we’ll go over every detail of your credit report with you, free of charge.

Resources:

Fair Credit Reporting Act

Fair Debt Collection Practices Act

Credit Repair Organizations Act

FAQs