DIY Credit Repair: Learn how to repair your own credit

This DIY credit repair guide will walk you through understanding credit reports, spotting and correcting errors, and rebuilding new, positive credit lines. We’ll provide all the essential information, tools, and dispute letters you need to understand credit reports, identify errors, and fix them on your own.

Get a free copy of your credit reports.

First, get a free copy of your credit reports by visiting annualcreditreport.com, where they can be accessed once a year.

Note that the free version does not include your credit score, so you may need to pay an additional fee to obtain it. However, if you have never viewed your credit score or if it has been a while since you last did, it may be worth the extra cost.

Reading your credit reports

There are five sections you need to look at. Here are some of the critical pieces of information that can be found in a credit report and tips on how to read them:

1. Personal Information: This section includes personal details such as your name, current and previous addresses, social security number, and date of birth. It’s important to review this section for accuracy to ensure that the information in the report pertains to you.

2. Credit Accounts: This section lists your credit accounts, including credit cards, loans, and mortgages. It includes the account’s opening date, current balance, credit limit or loan amount, and payment history. Review this section to ensure all the information is accurate and up-to-date.

3. Payment History: This section shows your payment history for each credit account. It includes information about whether payments were made on time or if there were any late or missed payments. Late payments can have a negative impact on your credit score, so it’s essential to review this section and ensure that all information is correct.

4. Public Records: This section includes information about bankruptcies, tax liens, and other legal judgments that may impact your creditworthiness. Review this section to ensure that the information is accurate and up-to-date.

5. Inquiries: This section shows who has accessed your credit report. There are two types of inquiries – hard and soft inquiries. Hard inquiries occur when you apply for credit, which can negatively impact your credit score. Soft inquiries occur when your credit report is accessed for other purposes, such as a background check or pre-approved credit offer, and do not impact your credit score.

Review your credit reports for inaccurate items.

Go over each of the above sections looking for negative, inaccurate information you’ll dispute. Paying close attention to every detail is essential. Even the slightest inaccuracy can harm your credit score, so you’ll want to dispute it. Here are the things you should look for:

- Incorrect personal information: such as name spellings, addresses, birth date, and employment history

- Credit and loan accounts: with inaccurate information, such as payment history, payment amounts, balances, and credit limits

- Missing accounts: Make sure all your good accounts are listed.

- Fraudulent activity: Addresses you’ve never lived at; medical or cellular accounts are all common signs of identity theft.

- Status of the accounts: Make sure the status of all accounts is accurate. E.g., opened, closed, paid in full etc.

Dispute inaccurate information

The next step in the DIY credit repair process is to dispute any negative, inaccurate information that you found in your credit report. You can do that with the credit bureaus by mail, phone, or website. I highly recommend you do it by regular mail, and it’s a good Idea to send all your disputes certified with a return receipt requested so you have a paper trail of your work.

Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30374-0256

866-349-5191

website

Experian

P.O. Box 4500

Allen, TX 75013

800-916-8800

website

TransUnion Consumer Solutions

P.O. Box 2000

Chester, PA 19016-2000

800-916-8800

website

How long do credit disputes take?

According to the Fair Credit Reporting Act (FCRA), credit bureaus have 30 days to investigate consumer disputes. The clock starts ticking from the date the credit bureau receives the dispute from the consumer.

During the investigation period, the credit bureau will typically contact the creditor that provided the disputed information (such as a lender or creditor) to verify the accuracy of the information. If the creditor confirms that the information is inaccurate or incomplete, in that case the credit bureau must correct or delete the information from the consumer’s credit report.

If the credit bureau cannot verify the accuracy of the disputed information within 30 days, it must remove the information from the consumer’s credit report. However, if the credit bureau later receives verification of the disputed information, it can reinsert the information into the consumer’s credit report after providing notice to the consumer.

Note: If the credit bureau receives new or additional information relevant to the investigation in the first 30 days, they can extend their investigation period. So it’s important not to send different disputes during that period.

Feeling Overwhelmed?

Schedule a free consultation and we’d be more than happy to walk you through the process.

Get late accounts current.

Now that you’ve got everything on your credit report accurate, it’s time to address the negative and accurate information, starting with late payments and collections. It’s important to get current on late payments as quickly as possible because the longer you don’t pay them, the more damage they can do, including turning into a collection account.

Contact each creditor you’re late with and make whatever arrangement you can to get current.

Tip: If you’ve had an otherwise good history with a creditor, you may be able to get what’s called a “Goodwill” or “Goodwill negotiations”. This essentially means your creditor may be willing to overlook the late payment since you’ve had a good history with them. This is a tactic we’ve used for a lot of our credit repair clients with pretty good success.

How to negotiate with debt collectors

Ok, so we’re getting closer to rebuilding your credit profile. To this point, you’ve made sure your credit report is accurate and you’ve brought yourself current on any late accounts. Now, let’s deal with any collections you may have. Some collection agencies can be very polite and easy to work with. Others can be a little aggressive, so it might be a good idea to familiarize yourself with the Fair Debt Collection Practices Act (FDCPA) beforehand.

Negotiating with debt collectors is straightforward. Be honest and polite, explain your circumstances, and let them know what you’d like to make payment arrangements. It’s essential to try and make all arrangements in writing, and don’t agree to anything you can’t commit to.

Most debt collectors are willing to negotiate reduced lump sum or monthly payments. Depending on your state’s statute of limitations, you may even be able to negotiate a pay for deletion.

How to deal with debt collectors when you can’t pay

If you don’t have the resources to make payment arrangements at the time, there isn’t much you can do except try to control the situation the best you can. You must keep in contact with the collectors because if you don’t, they might try and seek a judgment.

The FDCPA has some rules about calling you at work, what hours they can contact you, and how many times per day they can call.

Being in this situation isn’t pleasant, so the best you can do for now is to keep it tolerable.

Improving your positive credit

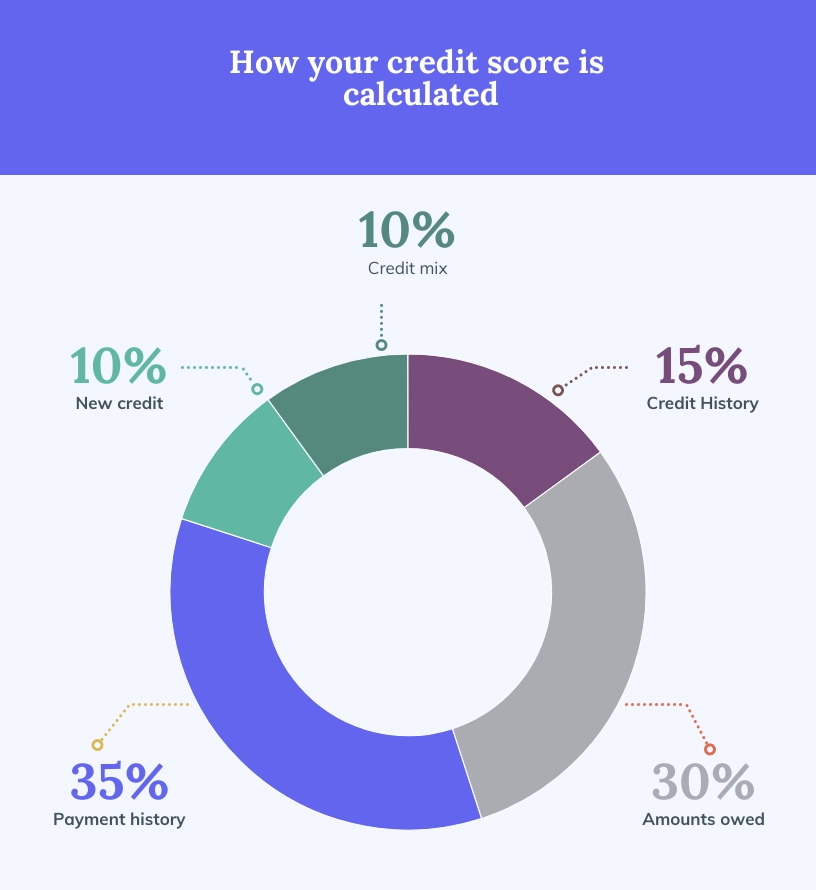

To this point, you’ve addressed the negative parts of your credit report; now let’s start improving your positive credit and overall mix of credit. This is important because 40 percent of your credit score is based on your balances and credit mix.

Balances: Your balances account for 30 percent of your FICO credit score. You want to keep your utilization below 30 percent. For example, if you have a $300 credit line, you don’t want to have a balance of over $100

There are four ways you can improve your utilization:

1. Pay down your balances below 30 percent utilization.

2. Open additional credit lines.

3. Get added as an authorized user. A friend or family member can add you as an authorized user and the entire history including balances and utilization will be applied to your credit report.

4. Request credit line increases.

.

DIY credit repair tips:

- Keep your balances below 30 percent of your limits.

- Don’t close accounts.

- Work towards a good credit mix.

- Make sure you keep current on all payments.

- Monitor your credit reports.

Additional resources to fix your own credit.

DIY Credit repair letters

There is nothing fancy about dispute letters, here are several resources and sample dispute letters to choose from.

Consumer Finance

Experian Dispute letter

MyFico Dispute letter

Frequently Asked Questions

Does paying off collections improve credit score?

Newer scoring (FICO 9 and Vantage scores 3 and 4 ) models do not count collections that don’t have a balance. So, if you pay a collection off it could improve your credit score. However, if a creditor you’re applying for credit with is using an older scoring model, your score will not improve.

Is It hard to fix your own credit?

It isn’t hard to fix your own credit, but it does take some research, time, and patience. Fixing credit whether you do it on your own or hire a legitimate credit repair company to do it for you takes time.

How long does it take to restore credit?

How long it takes to fix your credit depends on each person’s personal credit profile. It can take anywhere from 3 months to a year or two.

Can I pay someone to wipe my credit?

No. Companies who promise to wipe your credit, or erase all your negative information should not be trusted

What is a credit sweep?

Credit sweeps are an illegal tactic of disputing everything on your credit all at once. The only instance where it is legal is in cases of identity theft and the consumer has copies of police reports to back their claim. Otherwise, it’s most likely a credit repair scam and does not work.

Conclusion:

DIY credit repair is a viable option for those looking to improve their credit score. By following the steps outlined in this article, including reviewing your credit reports, disputing errors, and making consistent payments, you can take control of your credit and potentially save yourself money in the long run. While the process may take time and effort, the benefits of a better credit score are well worth it. Remember to stay disciplined and patient, and don’t hesitate to seek professional help if needed.