Best Credit Repair Companies

Introduction:

In this post, we’ll introduce you to some of the best credit repair companies in the industry, along with tips on how to choose the best one for your specific needs. So, whether you’re looking to repair your credit for a major purchase or simply want to improve your financial standing, keep reading to find the best credit repair company for you.

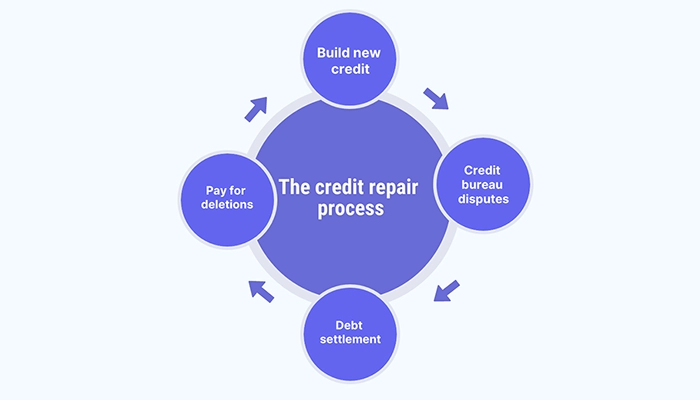

Credit repair basics: How it works

Credit repair typically involves disputing negative, inaccurate items on your credit report with the credit bureaus. However, disputing alone usually isn’t enough to have a meaningful impact on your credit. In fact, accurate items cannot be removed through disputes.

Therefore, the best credit repair companies also offer debt settlement as part of the process. This means negotiating with creditors to pay off debts and possibly even having them remove negative items from your report as part of the agreement.

Finally, a good credit repair company will also help you build new lines of positive credit once the negative items have been addressed. By doing so, you’re resolving debts in a legal, effective and permanent way.

Benefits good credit

Overall, having good credit can help you achieve greater financial stability and flexibility, opening up new opportunities and improving your quality of life. Here are some of the most compelling benefits of credit repair:

Lower Interest Rates: A better credit score can lead to lower interest rates on credit cards, loans, and mortgages. This can save you money in the long run and make it easier to pay off your debts.

Higher Credit Limits: An improved credit score can also result in higher credit limits, giving you more financial flexibility to make larger purchases or handle unexpected expenses.

Better Job Opportunities: Some employers perform credit checks on job candidates, especially those in finance or other fields that require handling money. A better credit score can increase your chances of getting hired or promoted.

Lower Insurance Premiums: In some cases, a higher credit score can result in lower insurance premiums, including car insurance and homeowner’s insurance.

How to choose the right credit repair company

Determining the best credit repair company depends on your individual needs and priorities. Factors such as price, reputation, and level of service should be carefully evaluated before making a decision.

Rather than reviewing specific companies, we’re going to focus on identifying key criteria to guide your decision-making process.

Consider these factors to help you choose a credit repair company that aligns with your unique needs and preferences:

Better Business Bureau Complaints: Look for a company with a good reputation. Check the number of complaints the company has with the BBB.

Transparency: A reputable credit repair company should be transparent about their services, fees, and process. Look for a company that provides a clear and detailed explanation of their services and pricing structure.

Experience: Consider the company’s experience and expertise in the credit repair industry. Look for a company that has been in business for several years and has a proven track record of success. Some companies may embellish about their experience, but you can check on sites like waybackmachine.org or whois.com to get a sense of how long they’ve actually been in business.

Services: As we mentioned earlier, it’s very likely you’re going to need more than just credit bureau disputes. If you know some of your negative items might be correct, than make sure you choose a company that offers pay for deletions and debt settlement. Otherwise, you might be wasting money.

Guarantee: Guaranteeing results is illegal in the credit repair industry according to the Credit Repair Organizations Act (CROA) However, any company confident in their services should offer a “satisfaction guarantee”. That’s pretty typical of most reputable products and/or services these days.

Free Consultation: One of the most important actions to take is to schedule a free consultation with any credit repair company you are considering. This will address many of the factors mentioned previously and facilitate your decision-making process.

Want a free credit repair consultation?

Schedule one today and a credit expert (not salesperson) will get right back to you.

Top rated credit repair companies

Below is a list of some of the oldest, most experienced credit repair companies in the industry.

The above mentioned credit repair companies are among the oldest in the industry, and the level of service, prices, number of complaints, and processes all vary. So it’s important to go over the points previously mentioned with each of them. Going over this checklist with each company may help you avoid credit repair scams.

Credit repair myths: What's real and what's not

There are many misconceptions and myths surrounding credit repair that can make the process seem more daunting or confusing than it needs to be.

Myth: Credit repair companies can instantly fix your credit score.

Reality: Credit repair takes time, effort, and a strategic approach to improve your credit score. Any company that promises an instant fix may be engaging in fraudulent or misleading practices.

Myth: Credit repair is illegal or unethical.

Reality: Credit repair is a legal and ethical process that helps consumers take control of their credit score and financial future.

Myth: Credit repair is expensive.

Reality: Credit repair does not have to be expensive, and there are many reputable companies that offer affordable services. Additionally, there are many free resources available online that can help you repair your credit score on your own.

Myth: Credit repair is only for people with bad credit.

Reality: Credit repair can benefit anyone, regardless of their credit score. Even if your credit score is good, there may be errors or inaccuracies on your credit report that could be negatively impacting your score.

Myth: You can’t repair your credit on your own.

Reality: While credit repair companies can be helpful, you may decide that it’s not worth paying someone to fix your credit you can also repair your credit on your own by reviewing your credit report for errors or inaccuracies, paying down debt, and practicing good credit habits.

It’s important to do your own research and consult with a reputable credit counselor or financial advisor before making any decisions about credit repair.

Alternatives to credit repair

If you are struggling with your credit score or financial situation, there are several alternatives to credit repair that can help you get back on track:

Create a budget: Sometimes steps to solving your problems could be as simple creating a budget. This can help you manage your money and prioritize your expenses. This can help you pay your bills on time and reduce your debt.

Consolidate debt: If you have multiple high-interest debts, you may be able to consolidate them into a single loan with a lower interest rate. This can help you pay off your debt faster and save money on interest charges.

Credit counseling: Credit counseling services can provide you with personalized advice on managing your debt and improving your credit score. They can also help you create a debt management plan.

Negotiate with creditors: If you are struggling to make payments on your debts, you may be able to negotiate with your creditors to work out a payment plan or settle the debt for less than the full amount owed.

Debt settlement companies: If you are unable to negotiate with your creditors on your own, a debt settlement company can work with your creditors on your behalf to settle your debts for less than the full amount owed.

Remember, the key to improving your financial situation is to take action and make changes that will help you manage your money and reduce your debt. It may take time and effort, but with perseverance and a solid plan, you can improve your financial situation and achieve your goals.

Fixing credit on your own

There’s nothing a credit repair company can do that you can’t do on your own. If you know you need to work on your credit, but don’t want to hire someone to do it for you, here are some steps you can take to repair your own credit.

Review your credit report: You can get a free copy of your credit report from each of the three major credit bureaus once a year. Review your credit report to identify any errors or inaccuracies and dispute them with the credit bureau.

Dispute errors on your own: You can dispute errors on your credit report by sending a letter to the credit bureau that issued the report. The Federal Trade Commission provides a sample dispute letter on its website.

Negotiate with creditors: If you have outstanding debts, you can negotiate with your creditors to work out a payment plan or settle the debt for less than the full amount owed.

Pay your bills on time: The most effective way to improve your credit score is to pay your bills on time. Late payments and missed payments can have a negative impact on your credit score.

Monitor your credit score: You can use a free credit monitoring service to keep an eye on your credit score and receive alerts if there are any changes or suspicious activity.

Remember, improving your credit score takes time and effort, but it is possible to do it on your own without the help of a credit repair company.

FAQs

How long will it take to fix my credit?

On average, the time it takes to fix bad credit can range from 3-12 months.

The amount of time it takes to repair your credit can vary depending on the severity of the negative items on your credit report and the steps you take to address them. Some minor credit issues can be resolved quickly, while more significant issues may take months or even years to fully address.

How much does it cost?

Prices among credit repair companies on average vary between $79 and $100 per month.

Can I repair my own credit?

Absolutely. There isn’t anything a credit repair company can do that you can’t do yourself.

Is credit repair legal?

Credit repair is legal as long as the methods used to repair credit are lawful and ethical. The Fair Credit Reporting Act (FCRA) and other laws regulate the credit reporting industry and protect consumers’ rights. Credit repair companies must comply with these laws when they provide credit repair services.

However, it is important to note that some credit repair companies may engage in unethical or illegal practices, such as promising to remove accurate negative information from your credit report or charging excessive fees upfront.

Consumers should be cautious when selecting a credit repair company and do their research to ensure they are working with a reputable and legitimate company.

Can credit repair lower your score?

Credit repair, when done properly and legally, should not hurt your credit score. In fact, if credit repair is successful, it may improve your credit score.

Credit repair typically involves identifying and disputing errors, inaccuracies, or outdated information on your credit report that could be negatively impacting your credit score. If these items are successfully removed, your credit score may improve.

However, while disputing items won’t directly harm your credit, of done improperly, it could prompt collection agents to try and seek a judgement against you.

What is a good credit score?

Generally, anything about 670 is considered good credit.