Credit Repair for Veterans

We all know how important it is to maintain your credit and credit repair for veterans is no different from for civilian or active-duty military members. As a spouse of a military veteran, I understand the highs and lows of active duty and post-duty and how credit can be impacted by military service. Below are a list of topics and advice on how to maintain and repair your credit report for during and post-military service members.

What are active duty alerts?

When a service Member is called to active duty or deployed away from normal duty, you can place what they call an active duty alert on your credit reports. This will lessen the risk of becoming a victim of identity theft. The credit bureaus will add this alert to your credit report and any business that runs your credit will see that alert. When that happens the business must verify identity prior to the extension of credit.

The alert is good for up to a year. You can request to have it removed sooner or extend it should your deployment last longer. It is also a good idea to opt-out of promotional offers. Although the active duty alert should reduce the number of pre-approvals you get in the mail, as a precaution, you can call 888-567-8688 to opt out of getting promotional offers while serving our country.

Below is the contact information for the credit bureaus regarding an active duty alert.

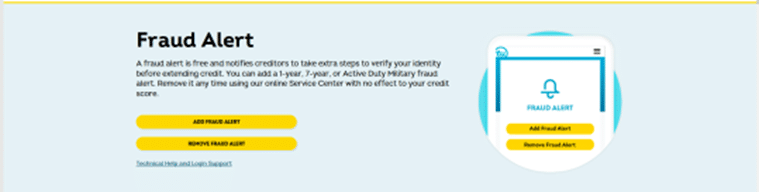

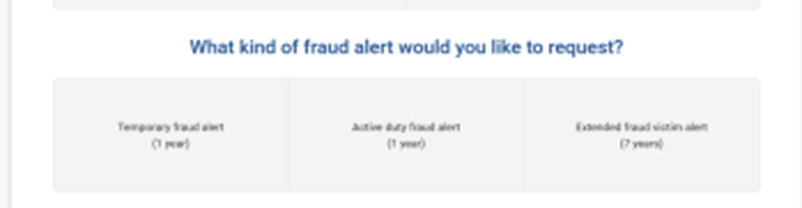

Experian: Go to Experian Click on “Add a fraud alert” – Then choose the type of fraud alert.

Equifax: Click on “Place an alert” – enter in the required information and then choose the type of fraud alert.

Transunion: Go to Here Click on “add fraud alert” – Create an account, if you do not already have one. Should be free to do.

Veteran Credit Repair

Now that you are out of the military you are ready to begin life in the civilian world. One of the first things to do is to check your credit reports to make sure everything is in good order and take care of anything that may affect you getting into a home, car or even a job you want.

When you run into issues that may be a problem on your credit report, look into getting them fixed. Below are some things to pay attention to depending on what you are looking to achieve.

Veteran Employment: If you are applying for a job in finance that requires a security clearance here is what you will want to focus your veterans’ credit repair on.

- For negative accounts that have been charged off, you will want to contact and set up payment arrangements or settle.

- Pay off or settle any collection accounts that are outstanding

- Check your public records for any outstanding judgments that need to be paid.

- If any debt is unfamiliar to you or is reporting inaccurate information, start the dispute process on them.

- Check your personal information section and clear up an error that may be appearing in that section.

-

-

Veteran Home Loans with bad credit: Yes, you can get a veteran’s home loan with bad credit. The VA doesn’t require a good credit score; however, lenders will. Below is a summary of the VA guidelines and ideally what you want your score to be.

– The FICO® credit score range is a minimum 580 – 620

– Chapter 13 typically requires a 12-month seasoning

– Chapter 7 requires a 2-year seasoning

– Typically, VA does not require collections and charge-offs to be paid; however, some VA lenders will.

– Judgements will be subject to either being paid off or in a repayment plan with a history of on-time payments.

General Credit Repair: When it comes to credit cards, auto loans, or if you are trying to start a business, having a well-balanced credit report and a good credit score will be very beneficial in helping you achieve those goals. The higher the score, the better the interest rate. Let’s go over the ideal credit profile.

Payment History: Payment history makes up 35% of your credit score. Keep your accounts current and paid on time. A late payment has a very significant effect on the credit score.

Amounts Owed: Amounts owed on a credit report make up 30% of your credit score. Owing money does not mean that you are less likely to obtain additional credit but you do want to keep your balances low, for example, if you have a credit limit of 1,000, try to keep your balances at 300 or below. Do not overextend, this could indicate to a lender that you are having trouble managing your credit.

Length of Credit History: Length of credit history makes up 15% of your credit score. The longer an account has been opened and in good standing, the more it benefits your credit score.

New Credit: New credit makes up 10% of your credit score. If you have a good credit mix, try not to open new accounts, doing so will bring the average length of credit history down. If you are re-building, try not to open too many accounts at once.

Credit Mix: Credit mix also makes up 10% of your credit score. A good credit mix to work towards is at least one installment account and 2-3 revolving.

Credit Repair Quotes

If after reviewing all the tools at your disposal to repair your credit on your own and still want to hire a credit repair company to achieve your goals. Do your research, there are a lot of credit repair companies out there.

Here are a few things to consider.

Make sure they give you a free consultation prior to any money being paid (sometimes all you need is a little guidance and not credit repair), ask for a credit repair quote, and about money-back guarantees.

Check to see if they offer military discounts for no other reason than because you deserve it.

Make sure when you are assigned a credit coach, that they will be the ones dealing with your credit from beginning to end.