Holiday Spending 2022 Biden vs. Trump

Did Americans enjoy holidays more under President Biden or President Trump?

How important is holiday shopping to the economy?

Consumer spending makes up approximately 70 percent of gross domestic product (GDP), and a good part of that spending comes during the months of November through December.

Now that Black Friday 2022 is over, here are the numbers:

Online shoppers spent a record $5.29 billion on Thanksgiving despite inflation fears. That’s an increase of 2.9% year over year according to Adobe Analytics, which measures e-commerce by tracking transactions at websites.

And $7.28 billion up through 6:00 pm ET on Friday 2022, according to Adobe. When the final tally is in, consumers will spend between $9 billion and $9.2 billion for the day, and set a new record.

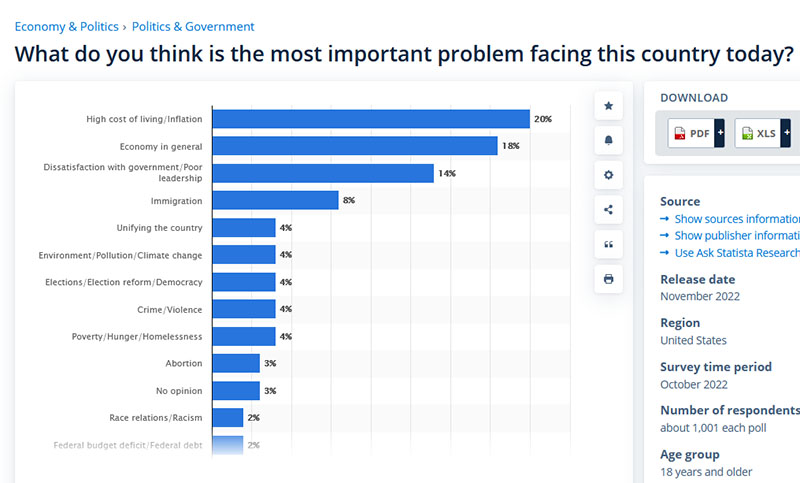

These numbers surprised many as the economy is at an inflation level, the highest in 40 years. And just days before the midterm elections, roughly 50% of Americans said the economy and inflation were their primary concerns.

In a poll released in October of 2022, Statista asked consumers:

[wp-faq-schema]

Also, according to an article by USA Today posted just days before Thanksgiving, Americans said they “intended to spend less this thanksgiving amid inflation/layoff fears.”

An early Christmas surprise for the President Biden?

Given the anxiousness consumers have been feeling about the economy in general, I’m sure this holiday record breaking numbers are a pleasant surprise to the Biden administration.

How do these numbers stack up to previous Black Friday’s?

According to Practicalecommerc.com Thanksgiving Day 2019 (pre-covid) had record online sales of $4.2 billion in the U.S. represent a 14.5 percent increase from 2018, according to Adobe Analytics.

Consumers spent $7.4 billion online, an increase of $1.2 billion over Black Friday 2018, making it the biggest Black Friday ever for digital sales.

Sales Report: 2019 Thanksgiving Day, Black Friday, Cyber Monday

Thanksgiving and Black Friday totals for 2019 vs. 2022

Biden: 12.57 billion

Trump: 11.6 billion

I can’t help but wonder whether the increase in spending for 2022 was pent up frustration from being locked down for much of the last two years due to COVID-19. Regardless, these are great numbers, and I’m sure the Biden admin is pleased (especially since he can say he beat Trump by nearly a billion dollars).

Looking forward

While the holiday numbers look good for President Biden, he should be cautious about taking a victory lap too soon. Republicans have taken over the house, which will make pushing his agenda through harder, and he still faces some big economic headwinds.

Consumer credit card debt

Since the Q3 of 2021 American’s credit card balances have risen by $121billion. That’s a 15% increase, the largest year-over-year jump in more than 20 years.

How much credit card debt do Americans have?

A whopping 925 billion in the third quarter of 2022 according to the consumer debt data from the federal reserve bank of New York.

Why is inflation so high?

The cause of inflation is often debated among economists (usually based on political party), regardless of the cause inflation is up 6.6% from a year ago, that’s the fastest pace in over four decades, and the highest it’s been since the 1980s

So what are the main causes of inflation?

1. Supply Chain issues

2. Stimulus checks

3. The Russian invasion of Ukraine

The fed has been jacking up rates to try and control inflation, but now it appears they’ll have to jack them up higher than expected and keep it there longer than expected.

Rising rates like this will mean higher loan rates and increase the chances of a recession.

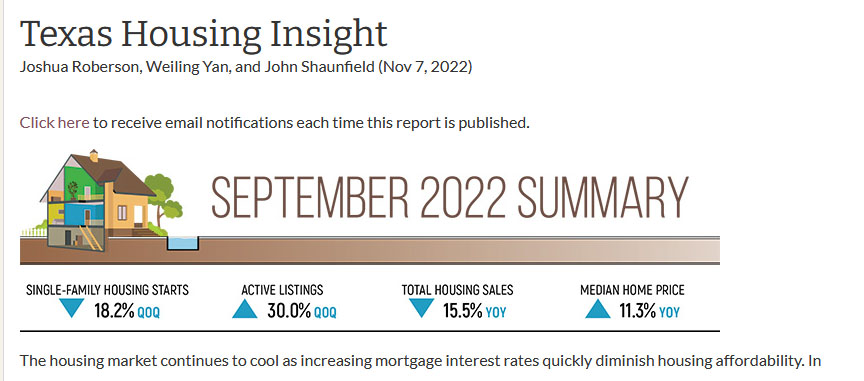

The Housing Market

In Texas, one of the fastest growing economies in the United States, the housing market is cooling as interest rates rise. Home sales have fallen more than 15% year-over-year and I don’t see that changing until the central banks see improvement on inflation.

A Lack Luster Stock Market

On January 20th, 2021, the S&P 500 closed at 3851 and just closed at 4026, just a 3% gain since President Biden officially took office. It has been seeing some signs of recovery in the last few weeks but sitting right underneath its declining 200 day moving average. Monday could be a key day for the market.

Conclusion:

If I’m being honest, I feel like perhaps the numbers show we’re doing a little better than they feel like they’re doing. Some of my findings did surprise me. But, as I said earlier, I think it would be prudent of the Biden admin from taking a victory lap.

He’s still facing a lot of economic headwinds, a split congress, Ukraine, COVID, and the country feels divided right now, and if these are all things he has to address over the next two years.