Beginners Guide to Credit Dispute Letters

Learn all about credit dispute letters. Which ones to use and when to use them to get the best credit repair results.

Introduction to credit dispute letters

Negative information on your credit report can be devastating, but in many cases, it can be fixed. And while you can’t remove accurate and verified information (the exception being a pay for delete), If you have something on your credit report that is inaccurate, outdated, or unverifiable, you can have it removed from your credit report. And that’s where a credit dispute letter comes in.

We’ll show you how, when, and which dispute letters to send to get the best chances of having the negative information removed. We’ll include sample dispute letters, templates, and PDFs for nearly every situation. So, let’s begin.

What is a Credit Dispute Letter?

The Fair Credit Reporting Act (FCRA) gives you the right to dispute any, and all information on your credit report that you feel is inaccurate, incompetent, or outdated. And if you’re disputing it with the credit bureaus, one of the options you have is using a credit dispute letter.

Now, I’m going to tell you something upfront. There is no magic dispute letter. No fancy legal language that makes one dispute letter work better than another. About 99.9% of credit repair companies send the same tired dispute letter template over and over for every client. How do I know? Because there are only a couple of credit repair software companies out there and they all come preloaded with the same dispute letters.

Once a credit repair company loads your negative information into the software they simply hit print, lick an envelope and drop your dispute in the mail. And this is why so many people say credit repair companies are a scam.

But don’t worry, we’re going to show you how to make them more effective. The trick isn’t the language in the dispute letter, it’s the timing, it’s state statutes, who to send them to, and when (and when not to).

Do credit dispute letters work?

Despite what I said above, a dispute letter can work if done properly. In our 19 years of repairing people’s credit, we’ve deleted potentially millions of negative, unverifiable accounts from our client’s credit reports.

When and when not to send a dispute letter

If you find an error on your credit report such as a late payment, collection, charge-off, etc. send a dispute letter to the credit bureaus. In most cases, the bureaus are required to investigate your claims within 90 days of receiving your dispute and close their investigation within 90 days.

When the investigation is completed, the credit bureaus will send you an updated copy of your credit report and let you know that they’ve either deleted the account or verified it as accurate in which case it will remain on your credit report.

Sounds pretty simple right? On the surface it is simple, but there are some major pitfalls to be aware of:

Things to be cautious of:

Sending multiple disputes too quickly:

Some credit repair companies tout how fast they dispute and re-dispute negative items. That sounds great, I mean you want your credit fixed as quickly as possible, right? But sending a dispute every 30-35 days can prolong the investigation process.

Example: If you have an item in dispute, and then re-dispute it 35 days later before the initial investigation is completed, the credit bureaus can consider that “new information” and your clock starts all over.

Not providing enough information:

When you send a dispute letter to the credit bureaus, you have to include the following:

-

- A valid form of ID

- Proof of residence such as a utility bill, etc

(1) Sufficient information to identify the account or other relationship that is in dispute, such as an account number and the name, address, and telephone number of the consumer, if applicable;

(2) The specific information that the consumer is disputing and an explanation of the basis for the dispute; and

(3) All supporting documentation or other information reasonably required by the furnisher to substantiate the basis of the dispute. This documentation may include, for example, a copy of the relevant portion of the consumer report that contains the allegedly inaccurate information; a police report; a fraud or identity theft affidavit; a court order; or account statements.

Failing to include any of these items could lead to disappointing results.

If you fail to do any of these things, the credit bureaus can label your dispute as frivolous, which means they don’t even have to investigate it.

This is one area credit repair companies can fall short. A lot of them fire off those template dispute letters without enough information and get their client’s reports labeled as frivolous.

THE BIGGEST DISPUTE LETTER MISTAKE OF THEM ALL!

This could end up being lengthy, but understanding every word of it is vital! This is my #1 warning against using “dispute mill” credit repair companies.

This is pertaining to using a dispute letter for collection accounts. Every state has a statute of limitations (SOL) on debts. Meaning, the period of time in which a collection agency has to take legal action against you. In Texas, for example, the statute of limitations is four years.

The SOL clock starts at the charge-off date or about 6 months from your last payment.

If a collection is past the 4-year SOL there isn’t anything the collector can do to you legally, except beg for the money.

If on the other hand, the collection is at say 3.5 years old for example, the collector does have the right to sue you. If they are successful, they’ll probably get a judgment that just made things a whole lot worse for you. What they’re able to do to you in terms of collection efforts at that point e.g. garnish wages, liens, etc varies state by state.

When will collectors seek judgments?

Ultimately, it’s up to the collector, but a few things to consider that may or may not factor into their decision-making process.

-

- Amounts over $1,000 seem to be more likely

- Homeownership

- Your employment status

- Whether or not you’re on disability

So, you’re probably starting to see where I’m going with this. Blindly disputing collection accounts like credit dispute mills often do, could lead to some big-time headaches. One thing that is key when choosing a credit repair company is their initial consultation.

Any credit repair company that doesn’t go over these things in detail (in other words, takes a just dispute everything negative approach) may be setting you up for some serious credit problems. They need to consider the things we just mentioned along with your state’s statute of limitations.

Here is a screenshot I just took of a credit repair company’s website. I can’t say what their process is, but we’ve been in this industry longer than most, and it’s a pretty safe guess In my opinion that this is a dispute mill. I say that because the emphasis should be on the consultation. Finding out things like your home ownership, your job status, and your state’s SOL.

When a company focuses on ease like “just sign up, we do the rest” could be a huge red flag.

At My Credit Group, our first priority above everything else is your safety. If during our free consultation we see a collection that is within the statute of limitations, we’ll discuss it with you. If you’re not absolutely sure it’s wrong, and with some solid evidence that it’s wrong, chances are we’re not going to dispute it.

We do have safer, more effective ways to deal with those items like debt settlement and pay for delete which are included free with our program.

Dispute Letter Sample

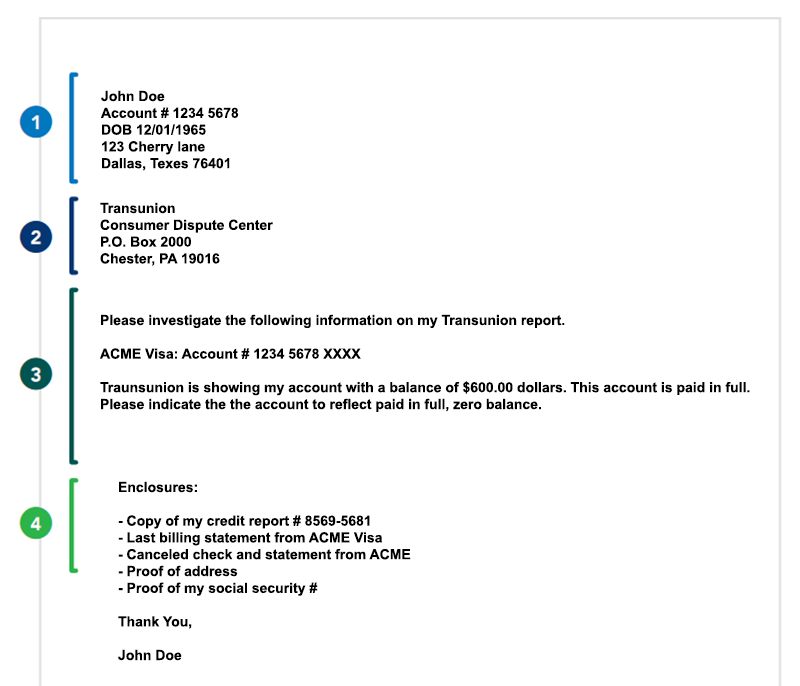

Now that we’ve gone over some of the dos and don’ts of dispute letters, without further ado, here is a sample dispute letter along with a free credit dispute letter template PDF

1) Full name, credit report ID #, Address

2) Name and address of credit bureau

3) Account and account # of the item in dispute. An explanation of the inaccuracy. What resolution you’d like to see.

4) Enclosures. Your proof of social, address, and all supporting documents regarding your claim.

Where to send dispute letters

Experian. Dispute Department.

PO Box 4500. Allen, TX 75013.

Equifax.

PO Box 74056. Atlanta, GA 30374-0256.

TransUnion Consumer Solutions.

PO Box 2000. Chester, PA 19016-2000.

Handwritten dispute letters vs. computer generated

This isn’t as big of a deal as it used to be, but I thought I’d bring it up. After all, this is the “ultimate guide to dispute letters” 😉

Back in the day, when we first started my credit group, we used to handwrite our dispute letters. The idea behind it was that a printed letter might look more obvious to the credit bureaus that the dispute is coming from a credit repair company. Back then, not as many people had home printers. Nowadays, everyone has them, so I don’t think it matters. I would, however, handwrite the envelope… it doesn’t hurt.

Dispute letters for medical bills

When it comes to medical collection disputes, you have two options:

-

- You can treat it like any other dispute and send a dispute letter to the credit bureau.

- You can send your dispute to the collection company trying to collect on the medical bill.

What’s the difference?

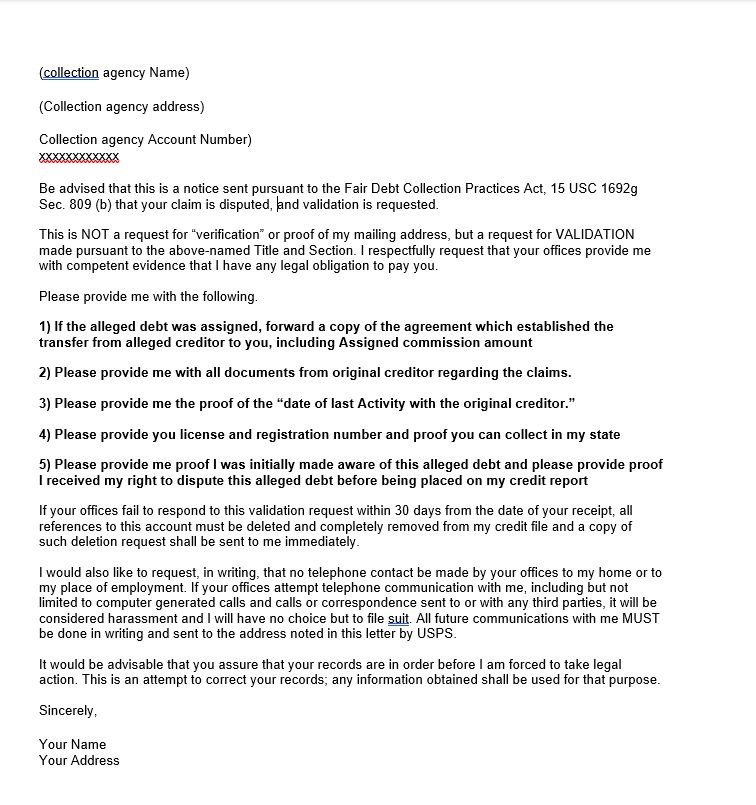

First off, when you send it to the collection company it’s not a dispute letter, it’s a “Debt Validation” letter.

On the surface it’s the same… you’re disputing the debt. But there is some nuance that we have found makes a big difference.

Let me explain…

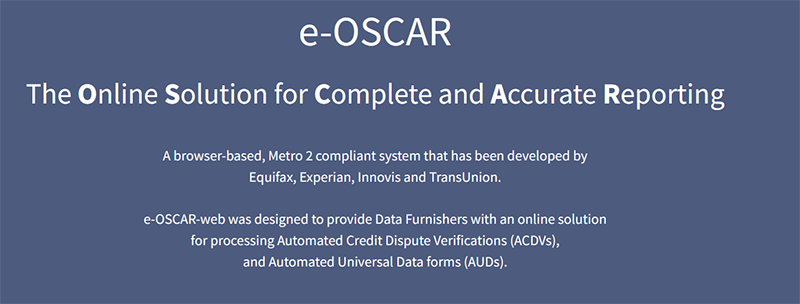

When you send a dispute letter to the credit bureau, they validate (or attempt to validate) it with the provider via a system called e-OSCAR

When the collector gets an electronic “dispute” from the credit bureaus, they can look in their systems, see that it is in fact a collection that they believe to be true (since ABC hospital sent it to them, it must be true) and they simply respond with whatever code they use in e-OSCAR. It’s a pretty quick and easy process for both the credit bureaus and collection company without any real investigation as far as we can tell.

When validate a debt with a bill collector, we’re now bringing into the Fair Debt Collection Practices Act (FDCPA) which is an entirely different set of laws, and method of validation on the collectors part.

Section 809 of the FDCPA says the following:

(a) Notice of debt; contents

Within five days after the initial communication with a consumer in connection with the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written notice containing —

(1) the amount of the debt;

(2) the name of the creditor to whom the debt is owed;

(3) a statement that unless the consumer, within thirty days after receipt of the notice, disputes the validity of the debt, or any portion thereof, the debt will be assumed to be valid by the debt collector;

(4) a statement that if the consumer notifies the debt collector in writing within the thirty-day period that the debt, or any portion thereof, is disputed, the debt collector will obtain verification of the debt or a copy of a judgment against the consumer and a copy of such verification or judgment will be mailed to the consumer by the debt collector; and

(5) a statement that, upon the consumer’s written request within the thirty-day period, the debt collector will provide the consumer with the name and address of the original creditor, if different from the current creditor.

If you, the consumer request validation of the debt within the 30-day time period the collector must stop all collection activities until he provides the requested information.

I’m going to write out the entire chapter on debt validation, but it’s really long and just as boring as you’d expect. If you’re interested, you can read about it here

The short version is this:

The process of debt validation in our experience, especially for medical bills is far more effective than disputing it with the credit bureau.

Here is debt validation sample letter:

HIPAA credit dispute letter sample

This isn’t a method I’d be too concerned about anymore, so I’ll just give you a short explanation as to why they used to be popular.

HIPAA credit dispute letters used to be popular because back in the day when we’d validate a debt for a medical collection, some medical bill collectors would validate it by sending a copy of the medical records from the dr. or hospital. We even got X-rays sent to us once as a method of validation. LOL

As you can imagine, sharing personal information like that was a huge HIPAA violation due to the fact that the Dr. or Hospital shared your personal medical history with a third party, and it gave us a ton of leverage.

Nowadays, it’s just not going to happen. We haven’t seen HIPPA violations like that in years. Basically, just stick with the debt validation letter.

If by chance, you get sent X-rays as a form of validation… congrats!

What is a 609 dispute letter?

A 609 dispute letter is actually not a dispute, but a way of requesting that the credit bureaus provide you with certain documentation that substantiates the authenticity of the bureaus’ reporting. If the credit bureaus are unable to provide the requested documentation, it could indicate that the item may be inaccurate.

Under section 609, you have the right to request:

All of the information in your consumer credit files

The source of that information

Each entity that has accessed your credit report within the past two years (unless it was to complete an investigation)

Businesses that have made soft inquiries within the past year

A lot of people think that section 609 requires credit bureaus to provide proof of your accounts-that is incorrect.

There’s nothing exciting about the wording of a 609 letter, although it does require you to include your own documentation.

Here’s a sample of a typical 609 letter:

Dear Credit Bureau

I am exercising my right under the Fair Credit Reporting Act, Section 609, to request information regarding an item that is listed on my consumer credit report. [List account names and account numbers]

Per section 609, I am entitled to see the source of the information, which is the original contract that contains my signature.

As proof of my identity, I have included copies of my Social Security card and driver’s license. I have also included a copy of my credit report with the account I am requesting to have verified.

If you are unable to verify the account with the original contract, the information should be removed from my credit report within 30 days.

Sincerely, [Signature][name][Phone number][Address, Social Security number, date of birth]

Are 609 letters effective?

We have seen nothing to suggest that 609 dispute letters are more or less effective than the usual process of disputing an error on your credit report—it’s just another method of seeking the accuracy of your credit report.

There is a flaw however in the 609 letter theory. The FCRA doesn’t require credit bureaus to keep or provide signed contracts or proof of debts, meaning that the information could still be found valid even if the specific documents you’re looking for aren’t, or can’t be produced. Therefore, we still think you’re best off with the standard dispute letter or validation of debt letters.

Sorry, it’s not the silver bullet you were hoping for. For some reason, every couple of years there’s another magic method of removing things from your credit report. That’s the internet for you.

Method of Verification letter

Personally, I think the method of verification letters is another internet rumor that has been overblown. But, here’s the story behind it (FYI in 18 years we’ve never used one if that’s any indication)

On second thought, I’m not going to waste your time on this one. It is simply a way of saying “hey, I don’t like the way you verified the accuracy of my credit report. I want the methods by which you did it.

Again, 18 years and about a zillion disputes and we’ve never used one. Meh…

Want to learn more about disputing inaccurate information on your credit report?

Feel free to set up a free credit repair consultation with My Credit Group. We negotiate more settlements and pay for deletes than any other credit repair company out there.

Our consultations are free, and we’ll help you out the best we can