What is a pay for delete?

A pay for delete is usually coupled with debt settlement, where a collection agency (not the original creditor) will agree to delete the negative item from your credit report in exchange for payment.

Does it work?

Assuming a collection agency wont negotiate to delete an item from your credit report after you’ve paid it, it can have a positive impact on your credit score. It will depend on your personal credit profile.

Are pay for deletions legal?

Pay for deletions would fall under the fair credit reporting act (FCRA) and is not directly mentioned or prohibited. This same sentiment is echoed in an article at Investopedia by consumer credit attorney Joseph P. McClelland in Decatur Ga.

I should however point out that the FCRA does state that you are entitled to “Fair and accurate credit reporting”. You shouldn’t dispute items you know are accurate

How to ask for a pay for deletion

If you do any amount of research online, you’re likely going to see places recommend that you send a pay for delete letter to the debt collector and insist he agrees to it in writing before you make any payments.

That is one option, but I tend to disagree. I have found that many debt collectors are hesitant to put an agreement to delete an item in writing. I will include a template sample letter at the bottom of this article if you’d like to try it.

The other way (where I have the most success) is calling the debt collector. Explain your situation, be honest and polite. Once you’ve come to an agreement on payment arrangements, politely ask them if they’d delete the item if you make the agreed-upon payment.

How much should you offer?

That’s going to depend on both the collection agency you’re dealing with, in addition to your state’s statute of limitations (SOL) on debts.

I mention SOL because if it’s within your state’s SOL, you don’t have the same bargaining power as you would if it’s past the SOL.

Within the SOL: I start all negotiations at 40% and try to land between 40-60%

Past the SOL: I’ll start at 30% and try to land between 30-50%

Calculating Statute of Limitations for your state

Just google “statute of limitations on debts (your state)” In Texas, for example, the SOL is 4 years.

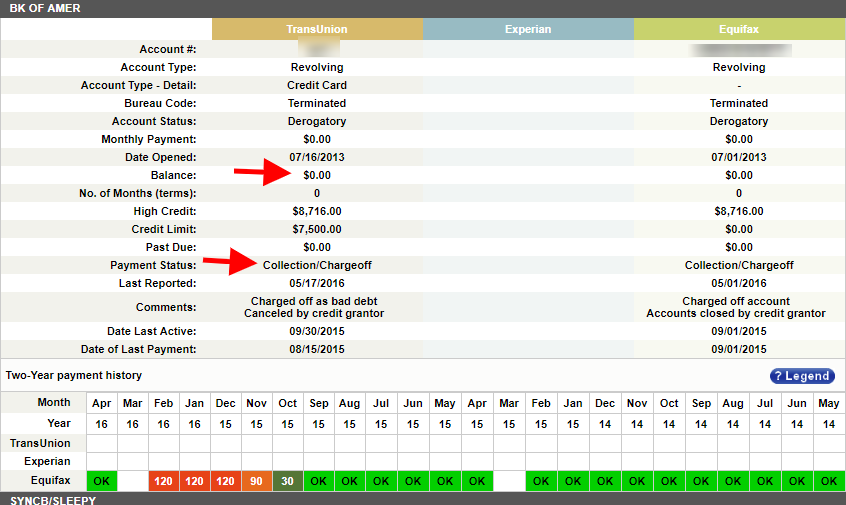

You can calculate whether it’s within the SOL or not by looking at the original account on your credit report and it will show the charge-off date. The SOL clock starts from that date.

What if the collector won’t agree?

This is common, but don’t worry, all hope is not lost just yet.

If a collector won’t agree to delete an item, just try and make the best settlement you can. A plan you know you can and will commit to.

If you’ve fulfilled your part of the deal by paying the agreed-upon amount, and you feel like something about the way the account is being reported isn’t accurate, you have the legal right under the FCRA to dispute the account.

We have found that a whopping 80% of collection agencies won’t respond to the dispute (because they’ve already been paid) in which case it will likely come off your credit report.

Please note: It is unethical, possibly even illegal to dispute accounts you know to be fair and accurate. However, if anything doesn’t look accurate to you such as the dates, dollar amounts, name of the collection company, last payment date, etc. Then you do have the right to challenge it.

Common misconceptions about pay for deletions

Misconception #1: They don’t work anymore because the new FICO® scoring model doesn’t count paid collections anymore”

That’s partially true. The new FICO 9 scoring model doesn’t ding you for paid collections anymore, but that’s referring to a base model.

An industry-specific model however still does because most of them still use older FICO scoring models. That includes auto loans, mortgages, sometimes credit cards etc.

Misconception #2: Even if it’s removed it can be put back on later.

Technically that’s true. But in 18 years of credit repair, I’ve personally never seen it happen.

Please note:

-

-

- Original creditors will not agree to do a pay for delete

-

- A pay for delete is for the collection. The original charge-off will remain

-

- They are not guaranteed. No one is required to make any type of settlement on the amounts you owe.

- Do not dispute items you know to be fair and accurate.

-

Download:

Pay for delete sample Template

Pay for delete FAQs